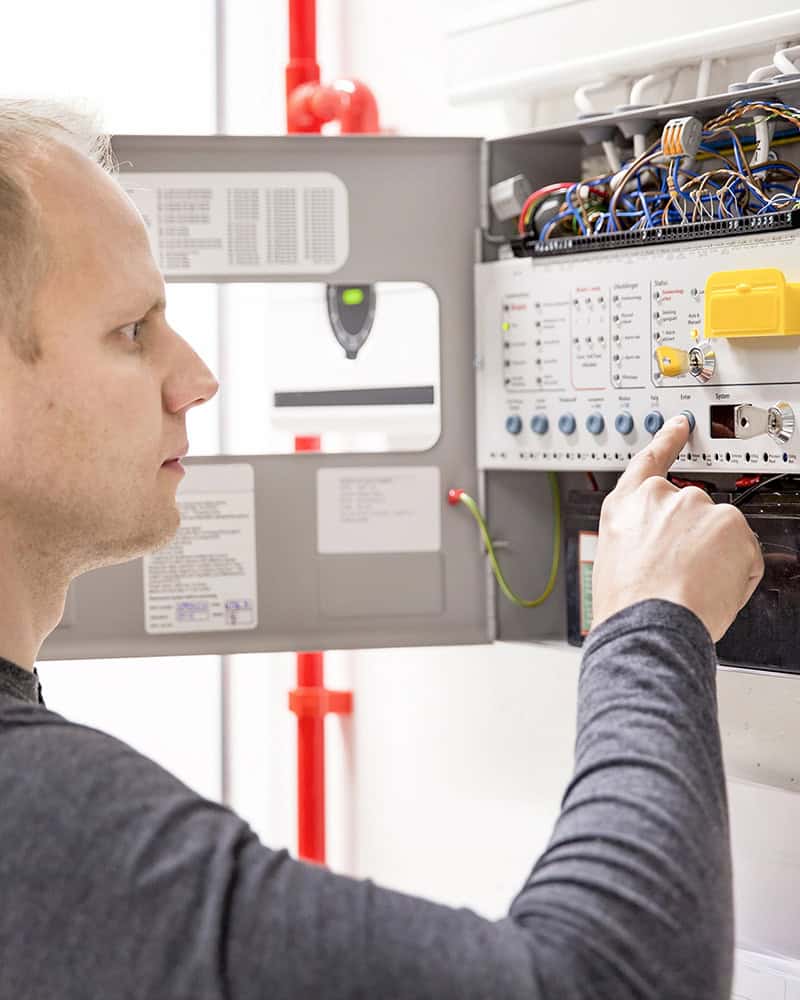

Fire Alarm Contractor Insurance

General liability & excess insurance for alarm contractors who design, install, inspect, service, or repair fire alarm systems.

Risk Suppression Partners provides fire alarm contractor insurance for Fire & Life Safety contractors, including general liability insurance and commercial excess insurance. Our exclusive focus on Fire & Life Safety allows us to deliver tailored, responsive claims handling and strategic loss control services, ensuring that fire alarm contractors get the protection and support they need to thrive.

Did You Know?

When you work with Risk Suppression Partners, you are gaining access

to top industry specialists in the Fire & Life Safety Industry.

Services Offered

In the process of protecting people and property, fire alarm contractors face liability risks unique to the Fire & Life Safety industry. Risk Suppression Partners underwrites insurance for fire alarm contractors, as well as providing risk management consulting services. Our expert, industry-specific loss control & risk mitigation services can help fire alarm contractors minimize liability & stabilize premiums. In addition, claims are handled promptly & efficiently by claims experts who have direct experience in the Fire & Life Safety industry. Our insurance offerings include:

- General liability insurance

- Excess insurance

- Underwriting

- Claims handling

- Loss control / risk management information resource

Application For Fire Alarm Contractor Insurance

Interested In Obtaining Fire Alarm Contractor Insurance? Apply Now. Download & complete the PDF of the application & email or FAX back to us for review.

What Makes Risk Suppression Partners The Go-To Source For Fire Sprinkler Contractor Insurance?

Risk Suppression Partners brings a powerful array of industry experts, skills, knowledge & experience to the table for Fire & Life Safety Contractors. Here’s what makes us different & the fire sprinkler contractor insurance provider of choice.

Specialists In Fire & Life Safety

We focus solely on underwriting insurance for Fire & Life Safety contractors.

Massive Fire & Life Safety Industry Expertise

Our team members have direct experience in the Fire & Life Safety industry.

Expert Team Of Fire & Life Safety Experts

We have a combined, expert knowledge of Fire & Life Safety that no one else can match.

Unique, Integrated Approach To Underwriting

Our underwriters, claims handlers & other team members work together seamlessly.

Insights From 4,500+ Fire & Life Safety Claims

Our experience with 4,500+ claims leads to continuous learning & process improvements shared with customers.

Direct Interaction With Agents & The Insured

We serve as an expert resource to agents & directly to contractors.

One-stop Shop For General Liability & Excess Insurance

We underwrite both general liability & excess insurance for Fire & Life Safety Contractors.

An Effective Claims Process

Our effective, responsive claims process is proven in the field.

Risk Suppression Partners’ Experience & Approach Benefit Fire & Life Safety Contractors

Our combined experience, industry-specific knowledge & proven processes yield significant benefits for Fire & Life Safety contractors. Here’s how:

Risk Mitigation

Our loss control & risk mitigation services can help contractors minimize liability.

Expert Resources

Fire and life safety contractors gain access to top industry specialists in fire and life safety risk mitigation.

Operational Improvements

Our risk mitigation & loss control resources can help improve operational best practices to mitigate enterprise risk.

Superior & Informed Claims Handling

In the event of a claim, RSP provides responsive claims handling with claims experts who have direct experience in Fire and Life Safety & field training on Fire and Life Safety systems.

Better Protection

By identifying & addressing exposures that most impact Fire and Life contractors, RSP provides the expertise & advocacy that best protects these contractors.

Peace of Mind

Working with Risk Suppression brings peace of mind to contractors, who know they’ll be provided expert guidance, expert claims handling, and an expert team.

Proud to Be Members of